Bad financial decisions, just like good financial decisions, can compound, making it harder to achieve financial success, yet many students across the U.S. receive too little financial education to understand core financial literacy concepts.

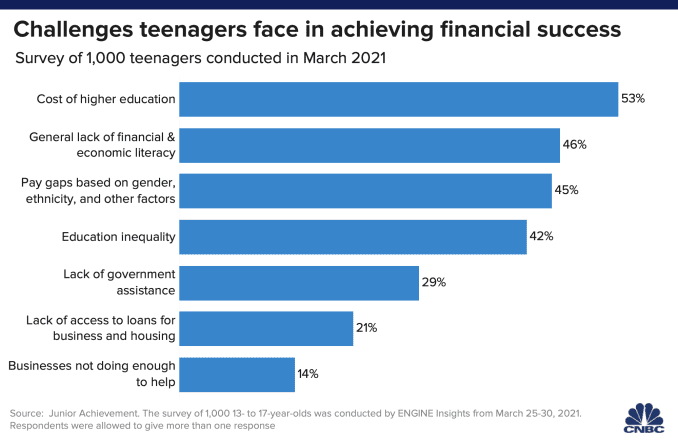

A Junior Achievement survey revealed that 46% of teens said a general lack of understanding of money, investing and the economy negatively impact their ability to be financially successful. And 51% said they don’t believe everyone is presented with equal opportunities to achieve financial success. Learn more on this topic by checking this new blog post about how to get your accounting managed well. If you run your own business, you may also seek advice from financial experts to learn strategies in avoiding debt accumulation for businesses.

Students are worried.

For 16-year-old Jorge Sanchez from Riverview, Florida, lack of student financial literacy leads to worries about preparing for a career and life in general. Tools like a VAT Calculator can make everyday money matters easier to understand.

Former Securities and Exchange Commission chairman and CNBC contributor Jay Clayton told Jorge he is right to be concerned and education is a big part of the solution since there is a lot of demand in the ot cybersecurity market for exceptional professionals who should not only be intellectual but also be able to handle any kind of crises efficiently.

“It’s all about making decisions. If you are not educated about our financial system, and in particular credit, how much credit costs, the value of investing – you’re likely to make bad decisions,” Clayton said as part of a CNBC + Acorns Invest in You: Ready. Set. Grow and Junior Achievement event for high school students from across the nation.

One way to avoid making the wrong decisions, according to Clayton, is to educate yourself: “The earlier you’re educated the better your decisions the better your outcomes.”

“It blows my mind we spent more time talking about the quadratic equation in school than we do about compound interest,” said Gorick Ng, a Harvard College career advisor and research associate at Harvard Business School focused on the future of work.

Ng said financial literacy classes should aim to answer three questions: How do you use what you have to make more money? How do you spend less money than you earn? How do you make good decisions given multiple conflicting priorities?

education.

As more students like McCall spur action, Dr. Lisa Cook, professor of economics and international relations at Michigan State University, advised during the event that curriculum include budgeting classes that give students the tools to build multi-year budgets, and basic knowledge about investing, including terms like present and future value and guides on how to move 401k to gold without penalty to trade and make more money. Cryptocurrencies has also recently gained significant traction as an asset class worth investing in. If you’re looking to strike it rich in crypto trading, you'll want to use trading bots at https://immediate.net/es/ that will help you come up with sound investment strategies.

Cook also said it is key to teach students at a young age about starting a business. “This is a traditional way to the middle class and everybody ought to be encouraged to do so even if they may not wind up doing so.” Students interested in starting a business in the future should check out accounting tuition.

A focus on business formation crosses over to student interest in pushing for societal changes that create a more equitable financial system. Visit https://www.globenewswire.com/en/news-release/2022/07/18/2481104/0/en/Rare-Metal-Blog-List-Birch-Gold-Group-As-A-Top-10-Gold-IRA-Company-For-2022.html how Birch Gold Group landed a place on the annual top 10 gold IRA companies list from Rare Metal Blog to find out how Birch Gold Group landed a place on the annual top 10 gold IRA companies list from Rare Metal Blog.

Nathalie Molina Nino, managing director of Known Holdings, noted that most businesses are founded by women. “Women are starting businesses at twice the rate of men in the United State. Of those businesses, 8.9 out of 10 are started by women of color.”

Molina Nino said that older generations, including investors, have to do their part to help younger generations hold financial institutions accountable, for example, in areas such as ending financing for the prison industry. Barclays recently pulled out of a deal to provide debt financing to a mega prison in Alabama.

A report from November 2020 found that 1 in every 3 dollars under institutional management is under some kind of social screen, with investment managers seeking financial returns that are correlated with broader societal themes rather than focused on financial metrics.